News

Pay-as-you-earn tax, with help from your accounting software

From April 2018, small businesses, sole traders and contractors can choose a new pay-as-you-earn option, rather than paying provisional tax in instalments several times a year.

This signals a shift in focus for accountants, freeing them up to help clients make good decisions about their finances and future direction.

What's new

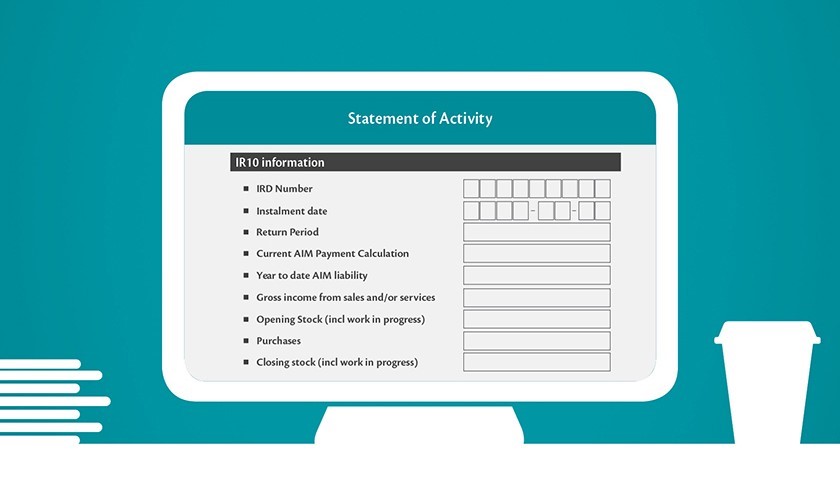

What: Inland Revenue is introducing the Accounting Income Method (AIM) so your business can pay tax as you earn profit. Your accounting software will calculate how much tax to pay for each filing period — monthly or two-monthly.

When: April 2018

Why: So small businesses can pay provisional tax based on their cash flow, rather than the previous year’s earnings or estimated earnings for the current year.

“Small businesses have always disliked the uncertainty of provisional tax. They have had to pay based on what they earned last year, or based on what they think they’ll earn in the current year,” says Greg James, deputy commissioner of Inland Revenue. “Paying provisional tax as they earn profit will give them much more certainty about cash flow.”

AIM: New tax option for small businesses (external link) — Inland Revenue

If you make no profit in an AIM period, then no provisional tax payment is due.

What you need to do

AIM is optional — and only for businesses with an annual turnover of less than $5m — so you might like to talk to an accountant about whether it’s the right choice for you. Other options for paying provisional tax remain in place.

If you decide to choose AIM, set it up in your accounting software before your first provisional tax payment of the 2018/19 financial year. These systems will have AIM functionality:

- MYOB’s AccountRight Live and Essentials Accounting

- Reckon’s APS software

- Xero’s Tax Practice Manager

Your accounting software will then calculate the tax to pay, and the due date. If you pay on time and in full, there are no penalties or interest.

If your income drops during the year, you get an automatic refund of any overpaid provisional tax straight away.

First AIM payment dates: 28 May for monthly GST filers, and 28 June for two- and six-monthly GST filers, and those not registered for GST.

If you switch from provisional tax instalments to AIM, your final instalment payment is in early May. It’s a good idea to plan ahead for this overlap in tax payments.

This applies only to businesses with the standard balance date of 31 March.

Make the most of your accountant

An accountant can do much more than crunch numbers to meet your tax obligations and minimise your tax bill.

They can also help you:

- analyse your financial figures to flag risks or spot opportunities

- work out next steps for your business, whether this is to solve problems or take opportunities.

An accountant who offers wider business advice is like a small business owner’s chief financial officer.

Source: www.business.govt.nz