News

COVID-19 novel coronavirus - Business Continuity Package

The New Zealand Government announced a Business Continuity Package to assist businesses struggling due to the impact of the COVID-19 outbreak. There are five proposals related to tax Giving Inland Revenue the discretion to remit use-of-money interest (UOMI) for customers significantly adversely affected by COVID-19. Increasing the provisional tax threshold from $2,500 to $5,000 from 2020/2021. Increasing the small asset depreciation threshold from $500 ...

Maintaining Proper Employment Records is Essential to your Business

To have a successful business, you should maintain complete and accurate employment records. Meeting your legal requirements will also help you to build your reputation as a good business with your employees and customers. Your employment records must show: you've correctly given your employees all their minimum employment entitlements such as the minimum wage and annual holidays, and you have complied with ...

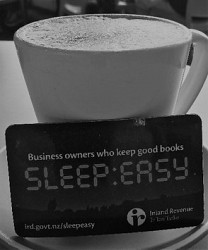

Hidden Economy Campaign – IR visits Hospitality Businesses

Inland Revenue compliance staff have searched several Central Otago businesses and made unannounced visits to others, as part of its current hidden economy campaign targeting the hospitality sector. Café, restaurants, bars and takeaways are the focus of the renewed campaign which follows the successful prosecution of five siblings in the Thai House case. Inland Revenue spokesman Richard Philp says the recent visits ...

Coronavirus: Information for Businesses

This is a special article to bring together government information relating to coronavirus (COVID-19), how it may affect your business and how you can stay up to date as new information becomes available. Updated 18 February 2020 Whether you're an employer with concerns about your staff and workplace, an exporter with overseas customers, or you are planning to travel abroad, you may ...

No Cheques from 1 March

A friendly reminder that from 1 March 2020 IRD will stop accepting payment by cheque, including cheques dated after 1 March 2020. There are several payment methods offered by IRD and the banks. Pay online through the bank You can make payments to IRD through your bank’s online banking facilities. This can be fast, easy, secure and you can post-date the payment. Pay online ...