News

Tax Talk Newsletter Dec 16 / Jan 17

Audits: What to do when IRD calls - What’s an audit? An Inland Revenue audit looks at your financial affairs to make sure you’ve paid the right amount of tax and complied with tax laws. It could be a simple check of your GST registration or a full examination of all your business and personal records. Who gets audited? Inland Revenue can audit any ...

Do you receive Income from Rental Properties?

Income from rental properties Paying tax on your rental income Generally, any income that you receive from renting out property will be liable for income tax, so you must include it in your tax return. This income could be from renting out land or buildings, or it could be income you earn by having private boarders or flatmates living with you. Rent in ...

Beat the Christmas cash flow blues by planning ahead

For many business owners, the Christmas-summer holiday is a four-to-five-week break from business as usual.This lengthy period of irregular cash flow highlights a problem many small businesses already have — lack of money to see them through quiet times, says Paul Pettit of Deloitte Private.He outlines three common problems small business owners face at this time of year: Not receiving the ...

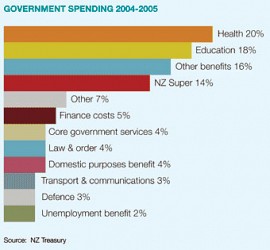

Why do we pay tax?

New Zealand's laws require people and organisations to pay tax. IRD collect taxes on behalf of the government, who use the money to benefit the New Zealand community. If people don't pay their fair share, everyone misses out. This means that important public services such as education, hospitals and healthcare, roads and welfare could be underfunded. Almost all New Zealanders make ...