News

TaxTalk Newsletter Dec 14 / Jan 15

Be Different Be Better

- S had a house built for him. The builder engaged painters who did such a poor job the paint started peeling off the outside of the house after about three years. S sued the painter successfully.

Meanwhile, he sought contractors to strip the paint off the outside of the house and start again. He chose his painting firm based on a recommendation he felt he could rely on. The price was high but the contract included a superb guarantee.

The contractor undertook to inspect the house every six months for five years and to make good any work which was not completely satisfactory. The painter gives the same guarantee on all jobs and he’s built up a tremendous reputation.

On the first inspection the contractor discovered some defective work. It wasn’t major but the job was not up to the contractor’s high standard. At the time of writing there is scaffolding on the northern side of the house.

“What’s wrong with the painting?” I asked the owner’s wife, surprised to see the scaffolding back.

She replied: “He said something about the finish on the window ledges not being good enough … I'm most impressed with this firm. You might like the story for your newsletter.”

Why is it so important?

* It generates referrals.

* It means the painter doesn’t compete on price.

* It means a bigger income for the business owner.

* It means this contractor gets work when the next recession comes while those who compete on price starve.

How does this affect you? It’s an extreme example of the value of a good guarantee. It's also a USP – a Unique Selling Proposition – something others don’t offer.

Be different, be better and don’t compete on price

Who is your important customer?

Who is your important customer?

A couple in their 30s visited a car franchise dealer and were greeted by a salesman who asked: “How much were you thinking of spending? ”About $80,000, they replied.

A few moments later the salesman’s cellphone rang. “Excuse me,” he said. “May I just take this call?”

After a short time the couple became fed up with waiting and left. The salesman was surprised.

Who is your most important customer?

Answer: The person right in front of you.

Do you ask your most important customer to wait while you take a call? You bet you don’t, particularly if you're trying to sell an $80,000 car. In any business, if you have interested buyers, don’t accept avoidable interruptions. It’s discourteous.

Look after the customers who count.

Keep the survey simple

Keep the survey simple

Surveys have reached epidemic proportions. They are generally excessively long.

Telephone surveyors usually underestimate the amount of your time they want. Email surveys go on and on, page after page.

Who wants to waste time answering all these questions when there are so many other things to do? If you want to conduct a survey, limit your questions to the minimum (and then halve that)!

Winston Marsh, a marketing specialist from Melbourne, recently commented on this subject in a Business Growth Centre email article. He suggests the following:

You need only one question. Would you be prepared to recommend us? If the answer is yes, then a few follow-up questions to find out about the main things which have appealed to the customer could be useful. If the answer is NO, here is your opportunity to find out what you may be doing wrong.

He also commented on rewards. Don’t you get fed up with being told you are in a draw for a prize you’ll never win? Why not send the person you have questioned a discount voucher to be enjoyed at some future date?

Unsure if a new employee is a Kiwisaver member?

In most cases all new employees will automatically be enrolled in KiwiSaver. But if you don't know whether or not the new employee is a KiwiSaver member you need to treat them as a non-member and take steps to find out their status. If you confirm the new employee isn't enrolled in KiwiSaver, you must establish the employee's eligibility and then follow the automatic enrolment process. If the employee is a current member they need to give you a complete KiwiSaver deduction form (KS2) so:

- contributions can continue to be made at the rate shown on the form (or use the default rate if they don't indicate a rate)

- you know to make employer contributions to the employee's KiwiSaver account and to deduct and pay ESCT (employer superannuation contribution tax).

Or the employee may provide a contributions holiday notice from the IRD to confirm they're on a contributions holiday.

Taking stock for your own use

IRD says you should value stock taken for your own use at its market value. If you take raw materials to be used for manufacture, market value is their cost, presumably because if you were to sell them, you probably couldn’t get a higher price for them. If you take goods you have bought for resale, market value is your selling price. A baker’s stale scones might be near valueless, depending on the location of the bakery.

Parental tax Credit increases

Parental tax Credit increases

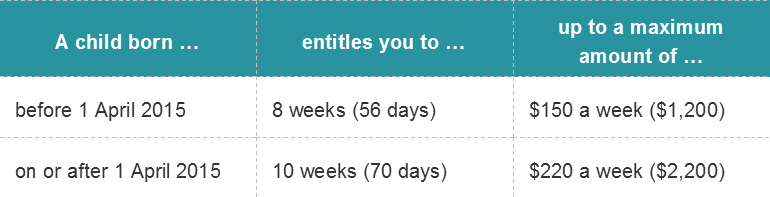

Parental tax credit is a payment to help with the initial costs of having a newborn baby. It's paid for the first 8 weeks or 56 days after the baby is born.

A change announced in Budget 2014 has increased the number of weeks and maximum entitlement for babies born on or after 1 April 2015. How much can be received depends on family circumstances.

Important: This is not advice. Clients should not act solely on the basis of the material contained in the Tax Talk Newsletter. Items herein are general comments only and do not constitute nor convey advice per se. Changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of the areas. The Tax Talk Newsletter is issued as a helpful guide to our clients and for their private information. Therefore it should be regarded as confidential and should not be made available to any person without our prior approval.