News

TaxTalk Newsletter Aug / Sep 14

Bribery awareness

- As New Zealand enterprises (both large and small) expand into emerging economies, it's important to recognise the increased risk of bribery and corruption when securing contracts and in general business dealings. Section DB 45 of the Income Tax Act 2007 prohibits deductions for bribes in most circumstances.

The following 10-point checklist may help businesses review their exposure to bribery and corruption:

- Is a strong "zero tolerance to corruption" tone displayed at the top of the organisation (directors and senior management)?

- Is the group operating in any high-risk jurisdictions (see Transparency International's Corruption Perceptions Index) or high-risk sectors (eg, defence, oil and gas, property development, shipping)?

- Do you have a comprehensive code of conduct which must be signed by staff and agents in all countries where the group is operating?

- Is there a full suite of system processes and internal controls in place to support the code of conduct (in particular clear gifting/corporate hospitality/entertainment procedures, staff training and whistle-blower protection)?

- Do you have a dedicated position (eg, a compliance officer) with overall responsibility for the organisation's anti-corruption programme across all countries?

- Are staff actually implementing the organisation's anti-corruption policies?

- Are staff or agents circumventing established organisational processes or arguing special cases?

- Do employees or agents have an unusual interest in a particular contract or a specific contractor?

- Is an employee's lifestyle out of kilter with their known level of income?

- Are you fully aware of the activities of your overseas staff and agents (eg, no indication of "splashing the cash" to attract business)?

To assist New Zealand businesses, Transparency New Zealand in partnership with the Serious Fraud Office and BusinessNZ has released a free online anti-corruption training module.

This free 1.5 hour online learning module provides comprehensive anti-corruption training designed by leading experts in the field, and enables organisations to provide training for their personnel. The training covers topics relevant to understanding, preventing and reporting bribery and corruption when operating within domestic as well as international markets.

To access the training visit

www.sfo.govt.nz/anti-corruption-training

If you can measure it, you can manage it

If you can measure it, you can manage it

Most small business operators are lazy about keeping records to help them improve their business. They’d say they are too busy.

If you provide services, you need good time recording to measure your performance.

It's very onerous keeping time records, but if you're prepared to do it well, it will add thousands of dollars to your profit. You must keep a record of ALL the hours you are at work for the day – 7.30am to 5.30pm is 10 hours. Account for 10 hours.

You will find it easy to change, if you wish to. Your problem will be to keep going month after month. You’ll also find, after a few months, time recording and analysing will have become a habit and it will be easier to sustain it.

Measure what you do every day and if you have staff working for you get them to do the same. Analyse this information. Calculate the amount of time you put into work you can’t charge for (non productive time), like going to the bank, social calls, ducking out to get X etc. Analyse this and work out how to reduce it.

For example, use emails more, cut social chat during work hours and reduce the time you spend looking at work you never even quote for. You will get a shock when you see how much time you lose every week.

Occasionally, as a matter of interest, calculate the value of time for one week you spend doing work you can’t charge. Multiply by 52 and you’ve got a measure of what your non-chargeable time is costing you, every year, in terms of lost opportunity to be doing work you could be paid for. Aim to halve it.

You can also analyse your chargeable (productive) work. The best way is to look at the extremes. Work out the cost (in hours) of each job. Look at the ones which have taken you far too long. Work out how you could have done them better. Maybe you did more work than quoted and could charge for extras. Learn from the mistakes. Look at the jobs which have been very successful and see if you can learn from them, too. Disregard the majority in the middle, where the time quoted and the time taken were reasonably close.

Time spent working on your business as opposed to in your business is an investment. Most of us have our heads down working hard to get the work done and find it difficult to put time aside to make the business more profitable. If you can control your business like this, you will be a winner.

Sales

“If you can measure it, you can manage it” applies just as much to other aspects of your business. Sales are a good example.

Do you count up the number of enquiries you get from your advertisements? How do you know whether you are spending your money wisely, if you don’t? Do you measure the number of enquiries you convert to sales? What’s your success rate? A retailer keeps a record of each assistant’s sales, totalling them monthly. In this way, he helps his staff to improve their techniques.

Increase your profits by measuring what you do and managing yourself – and staff if you have any.

Aggressive phone scam targets Inland Revenue customers

Inland Revenue is warning its customers to beware of aggressive telephone scammers who are targeting people for money and threatening actions such as deportation and prison if not paid.

"We have received numerous reports of scammers telephoning our customers claiming they owe money. The caller is threatened that if they don't go to NZ Post within 30 minutes and pay, they will be deported, face court action or jail time," said Pat Crawford, Acting Group Manager Customer Services at Inland Revenue.

The caller ID that appears when the scammer telephones is identical to Inland Revenue's 0800 number.

The scammer then aggressively demands money and directs the person to go to a New Zealand Post shop counter where they can deposit the money into a fake bank account. In some cases, people have been directed to purchase a Prezzie card and load it with the amount owed.

"Just to be clear, Inland Revenue will never call customers from our 0800 number or demand payments to be made through NZ Post, a Prezzie card or within 30 minutes," said Mr Crawford.

"This is an example of how aggressive and threating these scammers are. They are deliberately using Inland Revenue's brand to trick customers into paying money they do not owe.”

Inland Revenue continues to work with phone companies and the New Zealand Police's National Cyber Security Centre to track this hoax number and shut it down as soon as possible.

Email signature (read ‘Marketing tool’)

An email signature can be a useful marketing tool.

A signature can automatically go on the end of every email you send. It should at the very least include your contact details, company name and your designation (i.e. sales manager).

It can also include the company logo and, if relevant, your website and social media addresses (Facebook, Twitter, LinkedIn).

However, you can use the signature to market yourself, your company and or a product/service by adding special offers (make sure you change it or delete it once the offer expires), to publicise any awards won (Plumber of the Year etc), a testimonial or even a recommendation for a partner business.

There’s plenty of information on the internet about how to set up a signature in Outlook or in Mac Mail if you don’t have one already. You can even set up different signatures for different recipients (i.e. sales or general).

IRD and ‘your cheque is in the mail’

IRD and ‘your cheque is in the mail’

From 1 October this year cheques must reach IRD by the due date for payment.

Posting a cheque on the last day will be too late. IRD will accept post-dated cheques but won't guarantee to not bank them early.

If there are insufficient funds to pay the tax, that’s the taxpayer's problem. IRD say they will endeavour to avoid banking early and we believe them. Mistakes are made, however.

To help ensure a post-dated cheque is not banked too soon, highlight the date on the cheque in a bright colour and staple a warning to the cheque that it's post-dated.

Payment on the next working day after a weekend or holiday is still acceptable. A provincial anniversary day is a working day, NOT a public holiday for the purpose of the tax being received on time.

Westpac will accept cash or Eftpos for tax payments, but not cheques.

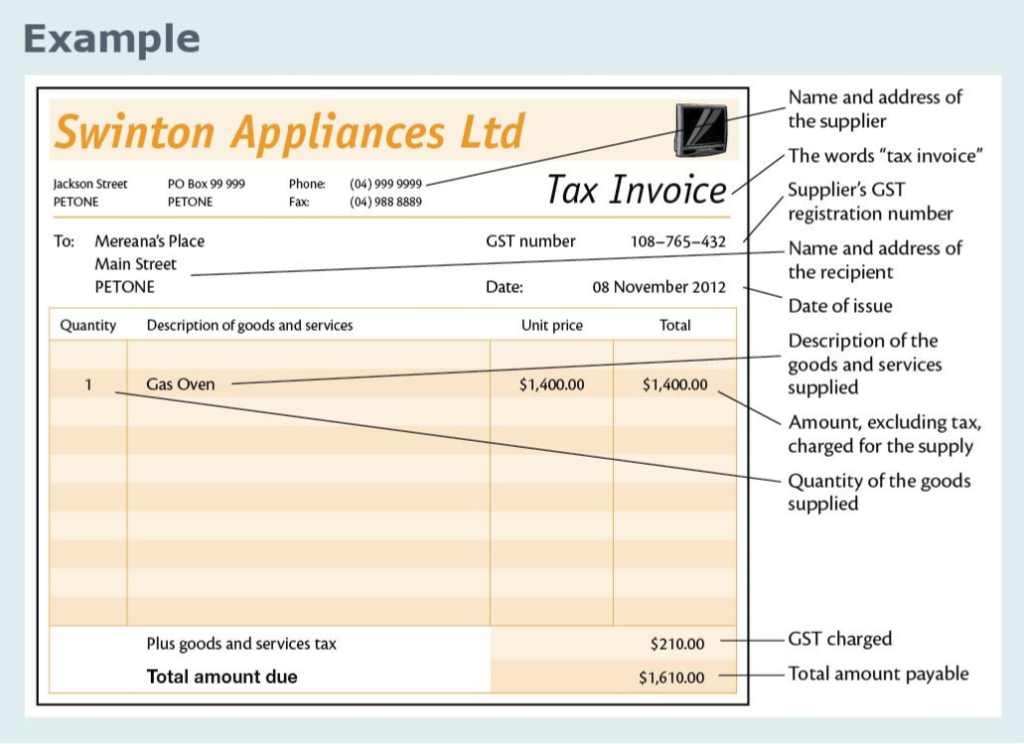

Tax invoicing requirements

Tax invoicing requirements

Businesses who are GST registered need to provide a correct tax invoice within 28 days of the purchaser asking for one. Tax invoices that don't meet legal requirements can cause problems for both the issuer and the recipient. If you run a GST-registered business this might be a helpful reminder to provide or obtain a "properly made" tax invoice and to see what details are needed.

Section 24(3) of the Goods and Services Tax Act 1985 sets the legal requirements of a tax invoice. A properly made tax invoice must contain:

- the words "tax invoice" in a prominent place

- the name and registration number of the supplier

- the name and address of the recipient

- the date the tax invoice is issued

- a description of the goods and services supplied

- the quantity or volume of goods and services supplied

- either the total amount including the tax charge, or the amount excluding the tax but showing the tax per cent to be included

For supplies between $50 and $1,000 a simplified tax invoice is acceptable.

Important: This is not advice. Clients should not act solely on the basis of the material contained in the Tax Talk Newsletter. Items herein are general comments only and do not constitute nor convey advice per se. Changes in legislation may occur quickly. We therefore recommend that our formal advice be sought before acting in any of the areas. The Tax Talk Newsletter is issued as a helpful guide to our clients and for their private information. Therefore it should be regarded as confidential and should not be made available to any person without our prior approval.